Apply Today!

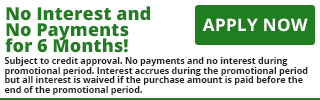

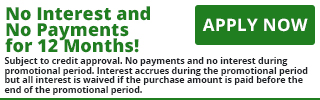

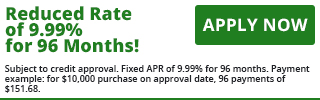

The GreenSky program’s focus is simple. We want to help you create the home of your dreams. From deferred interest promotions to affordable budget-minded options, our loans are an easy and convenient way to pay for any home improvement project.

Quick, Paperless Application Process

Online: Choose one of our Plans below.

or Apply by Phone

866-936-0602

When applying, you’ll need our GreenSky Contractor Number.

81007647

- Credit limits up to $55,000

- Fast approvals

- No prepayment penalties

- Friendly customer service

- Multiple ways to make a payment

- Affordable payment options

FAQs

Q: Why should I finance my project when I can pay cash or use a credit card?

Financing a project with GreenSky allows you to conserve both your money and your equity, and typically offers a lower interest rate than a credit card. GreenSky has many promotional offerings with deferred interest benefits, but without you having to pay out of pocket all at once.

Q: What type of credit does GreenSky offer?

We offer unsecured loans with fixed interest rates. Unlike a revolving credit card, your non-promotional monthly payment amount is always the same.

Q: Where can I use my loan?

Use your GreenSky Account Number to pay for services and products offered by the contractor with whom you apply.

Q: How do I make a payment?

It’s simple – pay online or by phone, or schedule automatic payments to be drafted from your bank account. The choice is yours. And there is never a penalty for paying off your loan early. Apply today at www.greenskycredit.com/consumer or call 866-936-0602 and be sure to use ARC Contracting’s Number which is above.

Q: How do I pay my Contractor?

Once approved, you will be provided a loan agreement and issued a 16-digit account number and expiration date. When you want to pay, just provide these numbers to your contractor to process the purchase as if it were a credit card.

Q: How long do I have to use my loan?

Once approved, you have four months to make your purchases.

Q: When is my first payment due?

Depends on your plan. Many deferred interest plans don’t require a payment during the promotional period. The first payment on a budget-minded plan is typically due approximately 30 days after the first purchase.

Q: When does the Deferred Interest plan promotion window begin?

At the time of your first transaction.